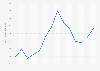

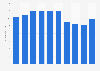

Volume index of motor vehicle production in the EU by country 2020-2025

EU motor vehicle production output nosedived amid the outbreak of the coronavirus crisis. In April 2020, the motor vehicle manufacturing industry across the 27 European member states had a volume index of only **** compared with the 2021 baseline of ***. While production volume started to rebound in May 2020, the global automotive semiconductor shortage had led to a slow slump of the volume index through March 2022, and production had been fluctuating again in 2023 and 2024, with Germany's particularly declining.

Production slows down amid pandemic lockdown

France, Spain, and Germany are among the leading producers of motor vehicles worldwide. The production index decreased in all of these countries and has not fully recovered from the outbreak of the coronavirus pandemic in Europe in the spring of 2020. The German motor vehicle production index, for instance, has been on the decline since September 2023, due to changes in the automotive industry in the country. The potential of tariffs from the United States in 2025 further suggests 2025 could be a complex year for the European Union's vehicle output. The European motor vehicle manufacturing industry had around *** million direct employees on the payroll, many of whom were faced with job insecurity from the onset of the pandemic. The COVID-19 pandemic forced factories to stop production in April 2020. Manufacturing facilities in most vehicle-producing regions have been affected after Europe became the outbreak's epicenter in mid-March. By July, many factories reopened, albeit at reduced capacities. European manufacturing firms rely on state aid to pay furloughed workers and prevent long-term plant closures.

Supply chain uncertainties affect restart

Production levels began to climb back towards the end of 2020. However, chip shortages and other supply chain uncertainties became the leading cause of concern between December 2020 and February 2022. As a result, Germany's motor vehicle production index dipped to **** in March 2022, with other regional markets following the same pattern. France and Germany, consistently below the European average volume index from December 2023 to February 2025, were the markets with the highest turnover from motor vehicle and trailer manufacturing in the European Union in 2023.