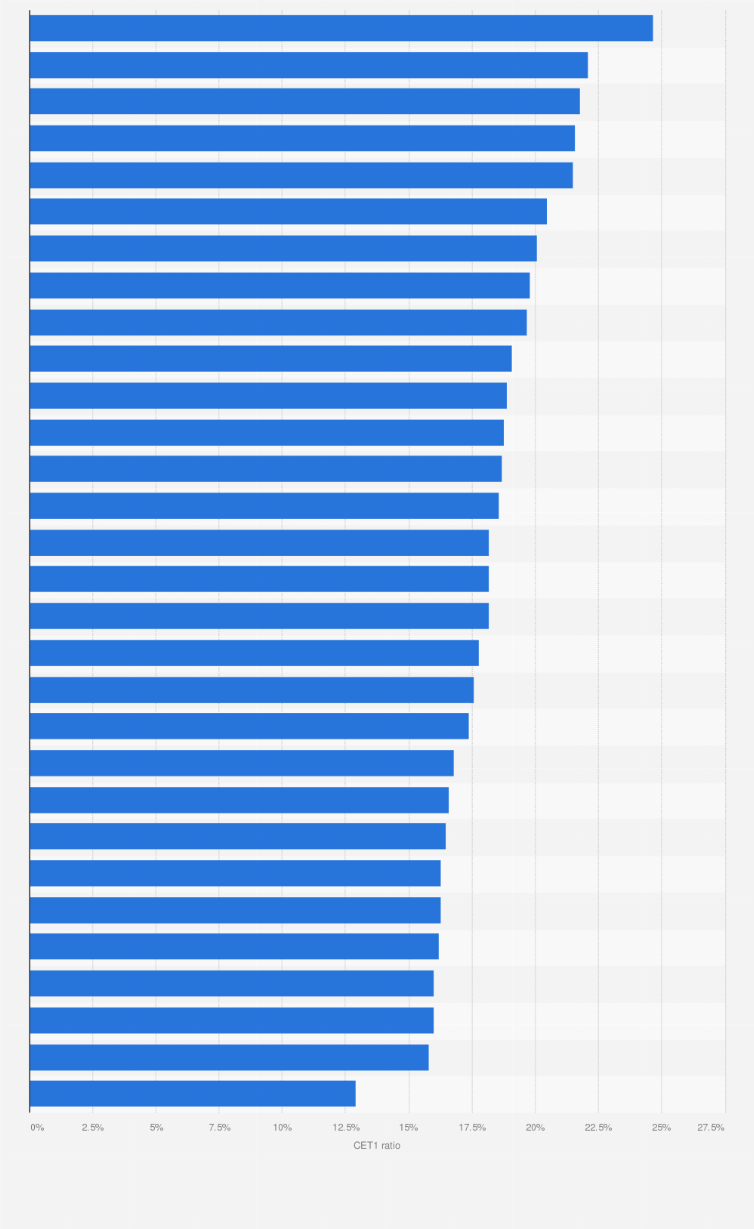

CET1 ratio of the banking industry in Europe Q4 2024, by country

Capital ratios express a bank's capital as a percentage of its risk-weighted assets (RWAs). Following the Basel III accord, European banks faced higher capital requirements phased in from January 1, 2015, establishing a new minimum Common Equity Tier 1 (CET1) ratio of 4.5 percent. As of the last quarter of 2024, all European banking systems exceeded the required CET1 ratio. Cyprus, Latvia, and Bulgaria maintained the highest CET1 ratios, while the Netherlands and Greece recorded the lowest.

European Banking Authority stress test

Since 2014, the European Banking Authority has conducted stress tests to assess whether Europe's largest banks could withstand another financial crisis. These tests measure each bank's capital ratio under a 3-year adverse scenario. In the 2025 stress test, all institutions except La Banque Postale were determined to have sufficient capital to weather a potential financial crisis. Goldman Sachs Bank Europe SE emerged as the top performer in this latest assessment.

Liquidity coverage ratio (LCR)

As of January 1st, 2015, it became a requirement for banks to hold a minimum of 60 percent in high quality liquid assets (HQLA), which allowed them to survive in times of liquidity stress lasting up to 30 days. This minimum requirement was to increase annually by 10 percent until it reaches 100 percent as of 2019. As of December 2024, all European countries were able to meet this minimum requirement.