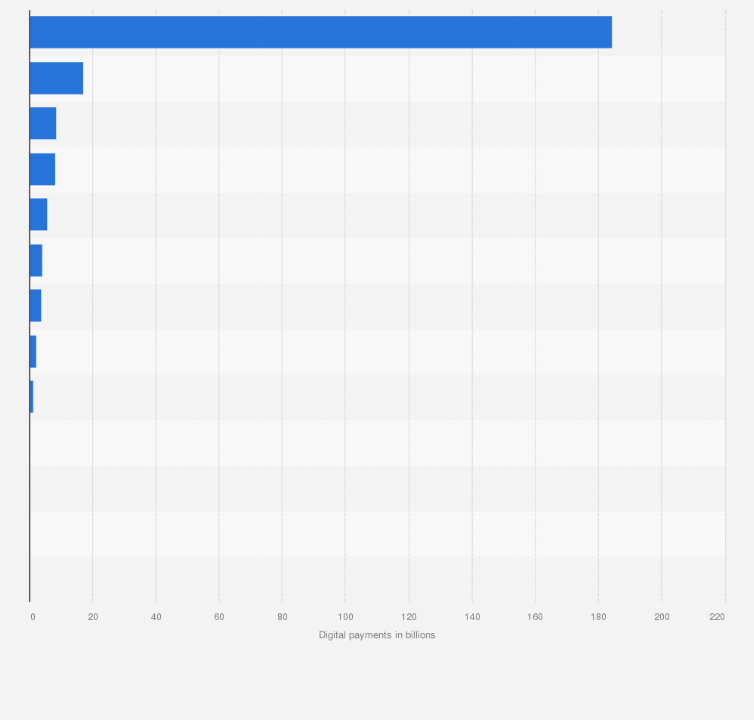

Volume of digital payments in India FY 2025, by mode

As of March 2025, the Bharat Interface for Money (BHIM) Unified Payments Interface (UPI) was the most used mode of digital payments in India, with a transaction volume of around 185 billion transactions. National Automated Clearing House (NACH) followed with around 17 billion transactions. The majority of the transactions across sectors such as online retail, food delivery, mobility, and e-health were made by UPI in the financial year 2023.

What is BHIM UPI?

BHIM is a mobile payment app developed by the National Payments Corporation of India (NPCI) based on UPI. It was launched in 2016 and it facilitates electronic payments directly through banks and promotes cashless payments. It allows users to send or receive payments using only a mobile number or UPI ID. As of June 2023, more than 200 Indian banks had partnered with BHIM.

Payment methods: a decade of transformation

The last decade has witnessed a significant transformation in the payments landscape in India. In the early decade, methods such as cash and cheques were prevalent. However, with the advent of smartphones and internet connectivity, digital payment methods started gaining traction. The government’s ‘Digital India’ campaign further propelled this shift, aiming to create a ‘digitally empowered’ economy that is 'Faceless, Paperless, Cashless’. Several digital payment methods emerged in this decade. Credit cards and debit cards became widely popular due to their convenience, portability, and security features. The introduction of UPI served as a game changer in the payments industry by facilitating instant money transfers between any two bank accounts via a mobile platform.