Fernando de Querol Cumbrera

Research expert covering construction, loans, leasing, savings, and debt

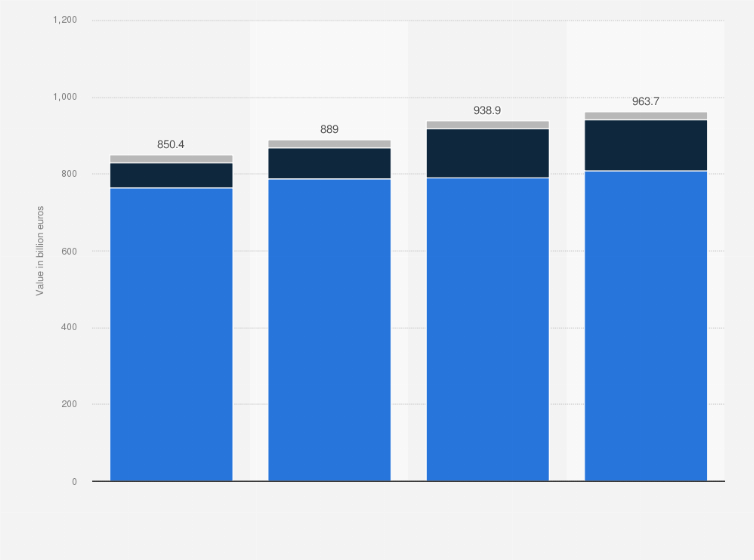

Get in touch with us nowThe value of outstanding credit-impaired (stage 3) loans by Groupe BPCE increased by over a billion in 2023. Meanwhile, the French cooperative bank had loans to customers and credit banks in the stage 2 amounting to 131 billion euros. As defined in the IFRS 9, when a loan's credit risk has increased significantly, it may be considered underperforming (stage 2), if its risk is even higher it may be classified as credit-impaired (stage 3). There were no French banks in the list of the ten largest sellers of NPLs in Europe.

* For commercial use only

Basic Account

Starter Account

The statistic on this page is a Premium Statistic and is included in this account.

Professional Account

1 All prices do not include sales tax. The account requires an annual contract and will renew after one year to the regular list price.

Overview

Western Europe

Central and Eastern Europe

Northern Europe

Southern Europe

Credit risk of European banks

* For commercial use only

Basic Account

Starter Account

The statistic on this page is a Premium Statistic and is included in this account.

Professional Account

1 All prices do not include sales tax. The account requires an annual contract and will renew after one year to the regular list price.