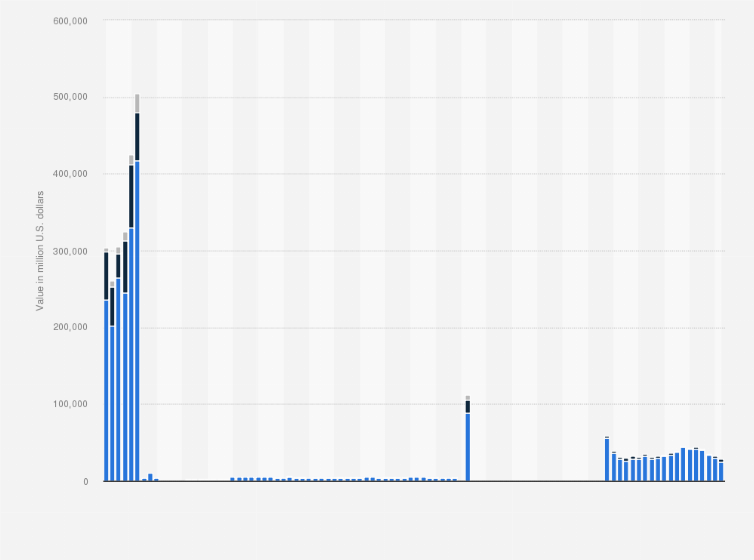

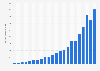

Fund flow of government (fees & gates) MMFs in the U.S. 2016-2024, by asset location

Fund flow to U.S. government fees & gates money market funds (MMFs) remained relatively low from 2021 to 2024. A peak level of fund inflow was reached in September 2016 when assets allocation exceeded 505 billion U.S. dollars. Most of that amount was allocated to funds domiciled in North America, with roughly 62 billion U.S. dollars worth of assets resting in European domicile funds. The following month, there was a large net outflow as the level of assets allocated to government fees & gates MMFs fell to approximately 28.8 billion U.S. dollars.

What is a government money market fund?

Government U.S.-based money market funds primarily allocate assets to securities backing cash, government securities, and repurchase agreements. Often liquidity fees are imposed to discourage outflows resulting from investors withdrawing their funds. Similarly, redemption gates are established to reduce the potential of forced sales. Government funds labeled no fees and gates provide an exemption from this.

How are fees and gates useful?

MMFs are highly liquid mutual funds and often offer higher interest rates than saving accounts. This is mainly due to asset allocation in high-quality, short-term debt securities offering a favorable yield. While MMFs do tend to require a minimum account balance they usually do not carry an entrance or exit charge. During times of market instability, MMF managers may use fees and gates as a tool to aid in creating solidity.