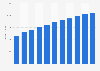

Government spending functions as a share of GDP in the UK 1978-2023

In 2022/23, the UK government spent approximately 10.2 percent of GDP on social security, compared with 8.4 percent for health, and 4.2 percent for education. These three spending areas have accounted for the highest share of government spending since the late 1980s. Defence spending as a share of GDP has, by contrast, fallen throughout this period, from a high of 4.6 percent in 1984/85, to just 1.8 percent in the mid-2010s.

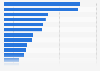

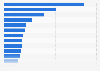

Main sources of revenue

During this same time period, income tax has been the most important source of revenue for the government, accounting for almost ten percent of GDP in the 2022/23 financial year. The UK's main tax levied on sales, Value Added Tax (VAT), was equivalent to 7.4 percent of GDP that year, with National Insurance Contributions at around seven percent of GDP. Taxes raised from businesses via Corporation Tax were the fourth-major source of tax revenue that year, at approximately 3.1 percent of GDP.

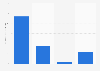

Debt and borrowing

Due to several years of the government spending more than it earns, the government has had to borrow large amounts to finance its commitments. This was especially the case at the height of the COVID-19 pandemic when, due to depressed revenues and increased expenditure, the government borrowed more than 314 billion pounds. This increased the national debt from 1.8 trillion pounds, to around 2.15 trillion pounds, or almost 97 percent of GDP.