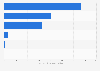

MAUs of leading dating and matchmaking apps in China 2024

Many well-established wedding planning companies in China have launched their dating apps with a marriage-oriented approach. Yidui was China's most popular dating and matchmaking app, registering over 5.8 million monthly active users in December 2024. Other major domestic competitors included Jiayuan, Yuehui8, and Zhen'ai.

Online dating: a pink bubble business?

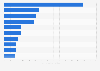

Despite a large user base, China's online romance business is not always profitable. Baihe was one of the country’s largest dating platforms that cover an array of services, from online matchmaking and offline events, to wedding planning services. In 2015, the enterprise merged with Jiayuan, its closest rival at the time, further consolidating its dominant position in the market with over six million combined monthly active mobile users in 2018.

Although Baihe Jiayuan doubled its revenue on the previous year in 2018, the enterprise reported a net loss for three years between 2015 and 2018, and its total monthly active mobile user base fell to below five billion in September 2019. A month later, the matchmaker announced that it would terminate its listing on the Chinese stock market to optimize its capital, followed by a rebranding into Lovelink in May 2022. Meanwhile, its major domestic contenders Zhen'ai and Youyuan have also experienced sales losses in recent years and hindrances in the attempt to go public.

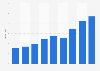

Why are users not paying for dating apps?

There are some difficulties in monetizing dating apps. According to a 2022 survey, dating apps appeared to be too superficial and time-consuming for new users. Of those who were already using dating apps, most tended to be quite satisfied with the functions offered in the free version. Premium features were not attractive enough for them to make subscriptions. In fact, the average revenue of online dating services in China remained below ten U.S. dollars. This might suggest a need for dating app developers and publishers to seek other monetization options, such as freemium, gifts and extra services, and advertising.