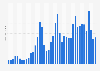

Biggest M&A inbound deals Europe 2024

In 2024, the acquisition of Covestro AG by Abu Dhabi National Oil Company was the largest in Europe, worth approximately 17 billion U.S. dollars. M&A can be used to fulfill several strategies including growth, expansion, increasing market share, eliminating a competitor or even talent acquisition.

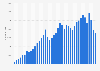

M&A in Europe

Inbound and outbound M&A, otherwise known as cross-border M&A is a deal between two companies that do not have headquarters residing in the same country. The largest merger and acquisition deal ever was the cross-border acquisition of the German company Mannesmann AG by British firm Vodafone AirTouch PLC in 1999.

Cross-border on the rise globally

Since 2010, cross-border acquisitions have accounted for approximately one quarter of all deals made, and around 40 percent of the total deal value. Regions such as Europe and South America rely on cross-border activity far more than others such as the United States and China.