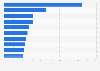

Quarterly sales volume of electric vehicles in Europe 2015-2025

Around ******* electric vehicles were sold throughout Europe in the first quarter of 2025. This sales volume includes sales of battery electric vehicles (BEV) and plug-in hybrid electric vehicles (PHEV). Europe is one of the leading markets for plug-in vehicle sales worldwide.

EV popularity and regional mandates keep the market growing

The European plug-in electric vehicle (PEV) market had declined by ***** percent year-over-year between 2023 and 2024 and subsidy rollbacks could impact sales even further. Road transport, including passenger cars, made up most of the European Union’s transport sector carbon dioxide emissions in 2022, amounting to around **** percent of the emissions. That same year, the use of electric vehicles in Europe displaced the equivalent of *** billion liters of gasoline, making a dent in the region’s motor fuel consumption. The benefits of electric cars still depend on consumers’ perception of EVs.

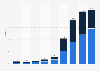

Charging infrastructure access impacts consumers’ perception

Over half of the consumers in the European Union reported intending to purchase a hybrid or electric vehicle in a survey from the third quarter of 2022, a share which dipped to ** percent in rural areas, where charging infrastructure is less accessible. Various factors can still make PEVs an inaccessible option for potential buyers. German consumers’ leading concerns regarding BEVs were their driving range, their cost, and the lack of charger at home. The rise in electric vehicle usage requires changes to the transport infrastructure, including a sufficient number of publicly available electric vehicle charging stations. Around ******* such charging stations were spread across Europe as of 2023. However, while the number of charging stations has increased, European countries still struggle to expand their network. There were under ***** charging locations per *** kilometers of roadway in Germany, France, Spain, and Italy as of July 2021.