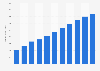

Most used e-commerce payment methods in the U.S. 2016-2024, with 2030 forecast

BNPL was not the most used payment method in U.S. e-commerce in 2024, although it did grow relatively quickly. The United States prefers credit cards and mobile wallets over other payment options, likely due to the popularity and user experience with mobile payment apps such as PayPal. The figures shown here are from before Apple entered the United States BNPL market. Installment loans through this specific provider may increase the market share of buy now, pay later. Apple Pay Later rushed to a penetration rate not far behind Affirm, only months after launch.

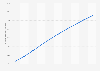

Wallets and credit cards: Less used than elsewhere

North America's use of credit cards and digital wallets in online shopping was not the highest in the world. A global comparison in e-commerce payment behavior shows that credit cards accounted for 35 percent of e-commerce payments in Latin America in 2022. North America's 31 percent was on par with the Middle East and Africa (MEA). Wallets are noticeably more popular in Asia-Pacific than in North America - reaching a 69 percent and 32 percent market share, respectively. This popularity of wallets causes predictions to be that the number of cashless payments will increase much more in Asia-Pacific than in Europe and North America combined.

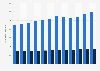

BNPL and crypto: The way forward?

Predictions are that eight out of 10 e-commerce vendors in the United States will offer buy now, pay later on their website come 2024. Respondents to a 2022 survey, especially, hoped to offer BNPL or cryptocurrency on their website within the next two years. One should note that the response pre-dated the fall of crypto exchange FTX. Additionally, the source does not clarify whether merchants would like to accept direct payments with Bitcoin or whether this involved a third-party payment aggregator.